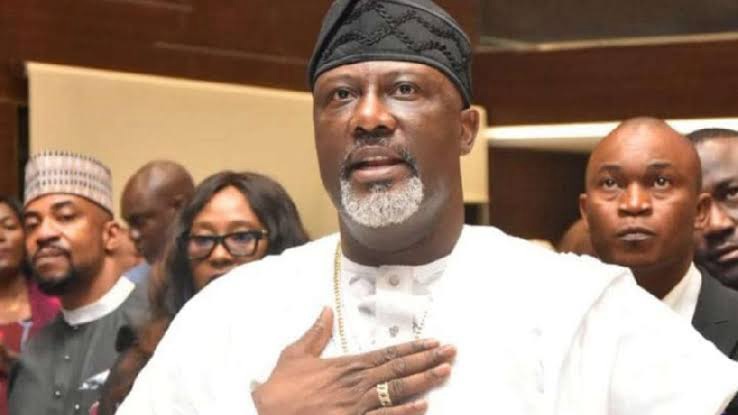

In a significant legal development, former Senator Dino Melaye, who represented Kogi West, has been summoned to appear in court due to allegations of tax evasion.

The summons, issued by a Magistrate Court in the Federal Capital Territory (FCT), raises serious questions regarding Melaye’s compliance with tax obligations for the years 2023 and 2024, as well as past underpayments for the years 2020, 2021, and 2022.

The criminal summons, dated August 21, 2025, mandates Melaye to present himself at the Magistrate Court located in Wuse Zone II, Abuja, on September 5, 2025. This court appearance comes on the heels of an investigation by the FCT Internal Revenue Service (IRS), which revealed a stark discrepancy between Melaye’s reported earnings and the taxes he has actually paid over the years.

Specifically, the IRS disclosed that Melaye’s tax payments have been alarmingly low in comparison to his declared income. For instance, in 2019, he paid a mere N85,000.08, which increased slightly to N100,000.08 in 2020 and N120,000 in 2021. In 2022, despite declaring an annual income exceeding N6.5 million, he only paid N1,000,000 in taxes. Such figures have prompted the IRS to question the integrity of his tax declarations and compliance with the Personal Income Tax Act.

The IRS took further action when they issued an administrative assessment for Melaye’s tax liabilities for 2023 and 2024 on May 23, 2025. However, Melaye’s failure to respond to this assessment within the stipulated 30-day period led the IRS to escalate the situation. On June 23, 2025, a notice of best judgment assessment was issued, and attempts to deliver this notice personally or to one of his representatives were unsuccessful. Consequently, the IRS resorted to pasting the notice on the gate of Melaye’s residence in Maitama, Abuja, on July 9, 2025.

The financial implications of these assessments are substantial. According to the IRS, Melaye’s total tax liabilities have been assessed at N234,896,000 for 2023 and N274,712,000 for 2024. The IRS’s notice indicated that despite having provided multiple reminders and sufficient time for compliance, Melaye’s non-compliance constitutes a breach of his obligations under Section 41 of the Personal Income Tax Act.

The notice clearly outlined the IRS’s intentions, stating, “Consequently, the Federal Capital Territory Internal Revenue Service (FCT-IRS) has, in accordance with Section 54(3) of the Personal Income Tax Act, proceeded to raise a Best of Judgment Assessment in respect of your tax liabilities for the years under review.” This statement underscores the gravity of the situation, as the IRS is empowered to take serious measures against individuals who fail to fulfill their tax responsibilities.

Furthermore, the IRS also identified underreporting of income and underpayment for the years 2020, 2021, and 2022, during which Melaye made negligible tax payments despite declaring considerably higher incomes. The IRS has indicated that additional notices will be issued upon the conclusion of their review, signaling that this case may evolve further as more details emerge.

Melaye, who has held various political positions, including serving as the chairman of the Senate Committee on the Federal Capital Territory and briefly chairing the Senate Committee on Aviation, has been a prominent figure in Nigerian politics. Most recently, he was the Peoples Democratic Party (PDP) candidate in the Kogi State governorship election held on November 11, 2023. His political ambitions and public image may now be significantly affected by these legal troubles.

In addition to the financial penalties he may face, the implications of this court summons extend beyond mere fiscal responsibility; they could tarnish Melaye’s political career and public image. He has been a vocal advocate for various causes during his time in office, and the current allegations may cast a shadow over his legacy.

As Dino Melaye prepares to respond to the court summons, the political landscape in Kogi State and beyond will be watching closely to see how this situation unfolds.