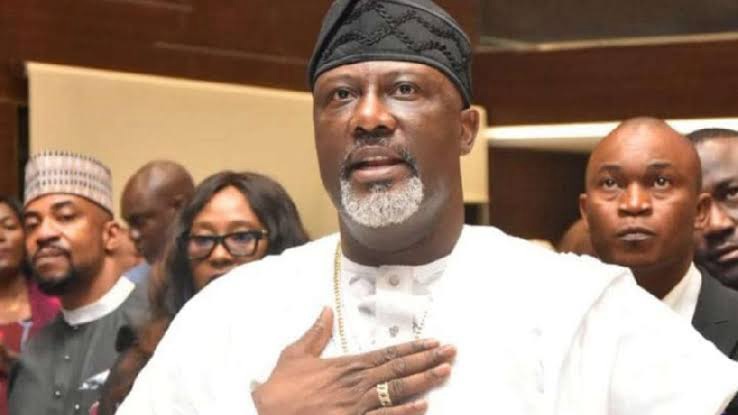

The recent remarks by former Kogi West Senator, Dino Melaye, regarding Nigeria’s escalating debt profile have stirred significant reactions from officials within the Tinubu administration, showcasing a palpable discomfort with the scrutiny of the government’s borrowing practices.

This tension highlights the sensitive nature of economic discussions in a country grappling with financial challenges.

Melaye’s assertion that the government might soon resort to borrowing from fintech companies like OPay and Moniepoint, if the trend of borrowing continues, reflects a critical perspective on the administration’s fiscal policies. His comments are not merely rhetorical; they resonate with public concerns about the sustainability of Nigeria’s debt levels. By questioning the rationale behind recent loan requests, particularly the $1.7 billion sought from the World Bank and the Senate’s approval of $21 billion in external borrowing.

In response, the presidency has characterized Melaye’s statements as “entertainment, not enlightenment,” a dismissal that underscores a defensive stance against criticism. Sunday Dare, the Special Adviser to President Bola Tinubu on Media and Public Communication, attempted to downplay the severity of the situation by citing data from the Debt Management Office. He argued that Nigeria’s debt-to-GDP ratio remains moderate compared to other nations, framing the increase in debt as a consequence of naira depreciation rather than reckless borrowing. This attempt to reframe the narrative indicates a government aware of the optics surrounding its financial strategies and concerned about public perception.

Furthermore, the former presidential spokesman, Reuben Abati, reinforced this defensive posture by dismissing Melaye’s critiques as politically motivated. By emphasizing that Melaye is a member of the opposition and questioning the legitimacy of his claims, Abati seeks to undermine the credibility of the criticisms while also diverting attention from the core issues raised about borrowing and fiscal management.

This back-and-forth illustrates a broader discomfort within the government regarding public discourse on economic management. The reliance on borrowed funds for financing infrastructure and reforms, while a legitimate practice, becomes contentious when juxtaposed against the backdrop of rising debt levels and public scrutiny. The government’s defensive reactions suggest a recognition that continued borrowing could erode public trust and provoke further political opposition, particularly as citizens grapple with the implications of such financial decisions on their daily lives.

In summary, the responses from government officials to Melaye’s comments reveal an administration on the defensive, grappling with the complexities of managing public perception while attempting to justify its economic strategies. The discourse surrounding Nigeria’s debt underscores not only the political tensions but also the urgent need for transparent communication and effective fiscal management to reassure a concerned populace.