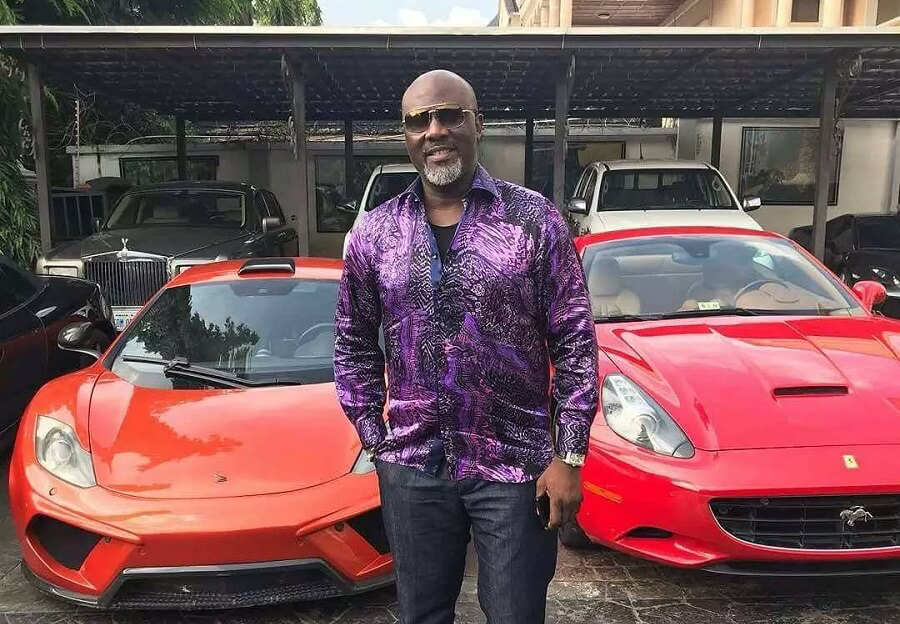

Former Senator Dino Melaye has recently made headlines by raising concerns about Nigeria’s rising debt. In a recent interview, he suggested that the Tinubu administration might soon have to borrow from local fintech companies like OPay and Moniepoint if the borrowing spree continues at its current pace.

His comments have rattled officials and supporters of the government, who seem uncomfortable with the scrutiny of their financial decisions, and has ignited a media storm at the national level.

Melaye questioned why the government is seeking a $1.7 billion loan from the World Bank and pointed out that the Senate has already approved around $21 billion in external borrowing this year. He argues that this level of borrowing is unprecedented and goes against the government’s promise to cut wasteful spending.

In response, Sunday Dare, the Special Adviser to President Bola Tinubu on Media and Public Communication, dismissed Melaye’s statements as mere entertainment, saying they lack substance. He pointed to data from the Debt Management Office, stating that Nigeria’s total public debt was ₦149.39 trillion as of March 31, 2025. Dare explained that the increase in debt is mainly due to the depreciation of the naira and not because of irresponsible borrowing. He also mentioned that Nigeria’s debt-to-GDP ratio is still manageable compared to other countries like South Africa and Ghana.

Reuben Abati, a former presidential spokesman, also weighed in, saying that Melaye’s comments are politically motivated. He questioned the credibility of Melaye’s claims and noted that the government is not looking to borrow from fintech firms like OPay and Moniepoint, as they don’t provide the kind of funds the government needs. Abati also addressed the controversy around the claim that President Tinubu has a yacht funded by taxpayers, clarifying that it was part of a naval operation and not a luxury item for the president.

The reactions from government officials show that they are on the defensive, trying to manage public perception of Nigeria’s financial situation. The discussion around borrowing is sensitive, especially as many citizens are concerned about how it affects their lives. The government’s effort to downplay Melaye’s comments suggests they are aware of the political and public trust issues at stake.

Overall, the back-and-forth between Melaye and government officials highlights the ongoing tension regarding Nigeria’s debt and raises questions about the country’s financial management. As the government continues to seek loans for infrastructure and reforms, it will need to communicate clearly with the public to maintain trust and confidence.